Stocks Form 16 Domestic Business Corporation Annual Report – If your business is required to do so, you should make sure to submit your annual report form on time. In general, it’s April 30, even though the deadline varies by industry. A copy of the form may be downloaded, by clicking the provided link. Both time and money will probably be preserved. Additionally, declaring it on the internet will save you dollars.

On-line filing reduces fees.

The twelve-monthly statement for your organization may be presented easily by sending once-a-year record types on the web. Saving time and money is among the many great things about accomplishing this. , although online form submission does have some disadvantages For instance, your annual report form can be returned to you if it is impossible to read your handwriting. Electronic filing requires both the online submission of the annual report form and the online credit card or debit card payment of the filing cost, however. United states Express can also be recognized in a number of claims.

If you don’t submit your online annual report forms on time, it can cost you money. Nearly all states need yearly reviews be submitted. For instance, not for profit agencies are exempt from processing service fees but are nevertheless encouraged to produce a version for his or her information. Annual report forms must also be submitted by a specific deadline in order to avoid being viewed as delinquent and rescinded. In a few suggests, you have three months in the thanks day to submit your records. Your business may be deemed in default if you don’t submit your paperwork on time, and your records may be permanently destroyed.

Federal securities polices mandate it.

The transaction of securities is controlled by a set of rules and laws called the government securities laws and regulations. These legal guidelines are focused to combat fraudulence in the purchase of securities. On the whole, the Securities Act of 1933 mandates that buyers get whole disclosure of securities ahead of their buy. As soon as the protection is sold by way of postal mail, the take action also mandates disclosure.

Companies must publish recurring reports for the SEC. These records must be according to monetary records certified by independent accountants. These records can be found in the EDGAR data bank and should be disclosed to traders.

Needs fluctuate by express

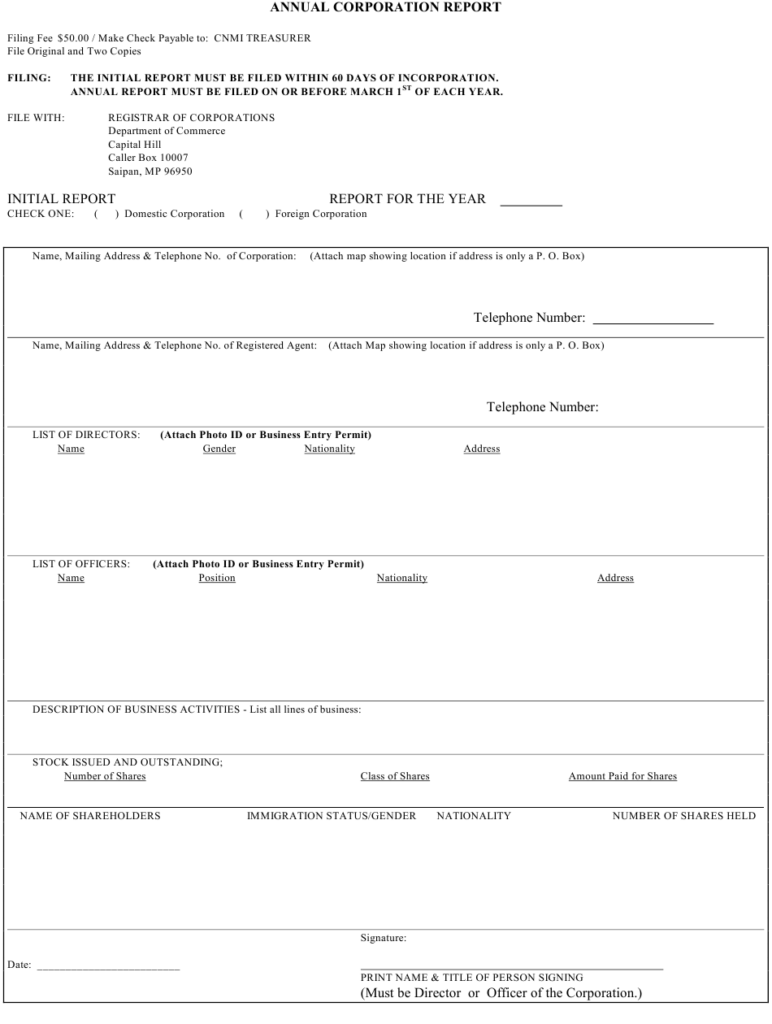

Depending on the state you do enterprise in, twelve-monthly record filing is usually necessary. Some states require filing of an annual report before a fixed calendar date, while others have a different due date based on the anniversary of the business’ formation. Your annually document may also have to be sent in in electronic format or on paper according to the status. It is actually suggested that you simply send your once-a-year document develop as early as possible to prevent late fees and penalties.

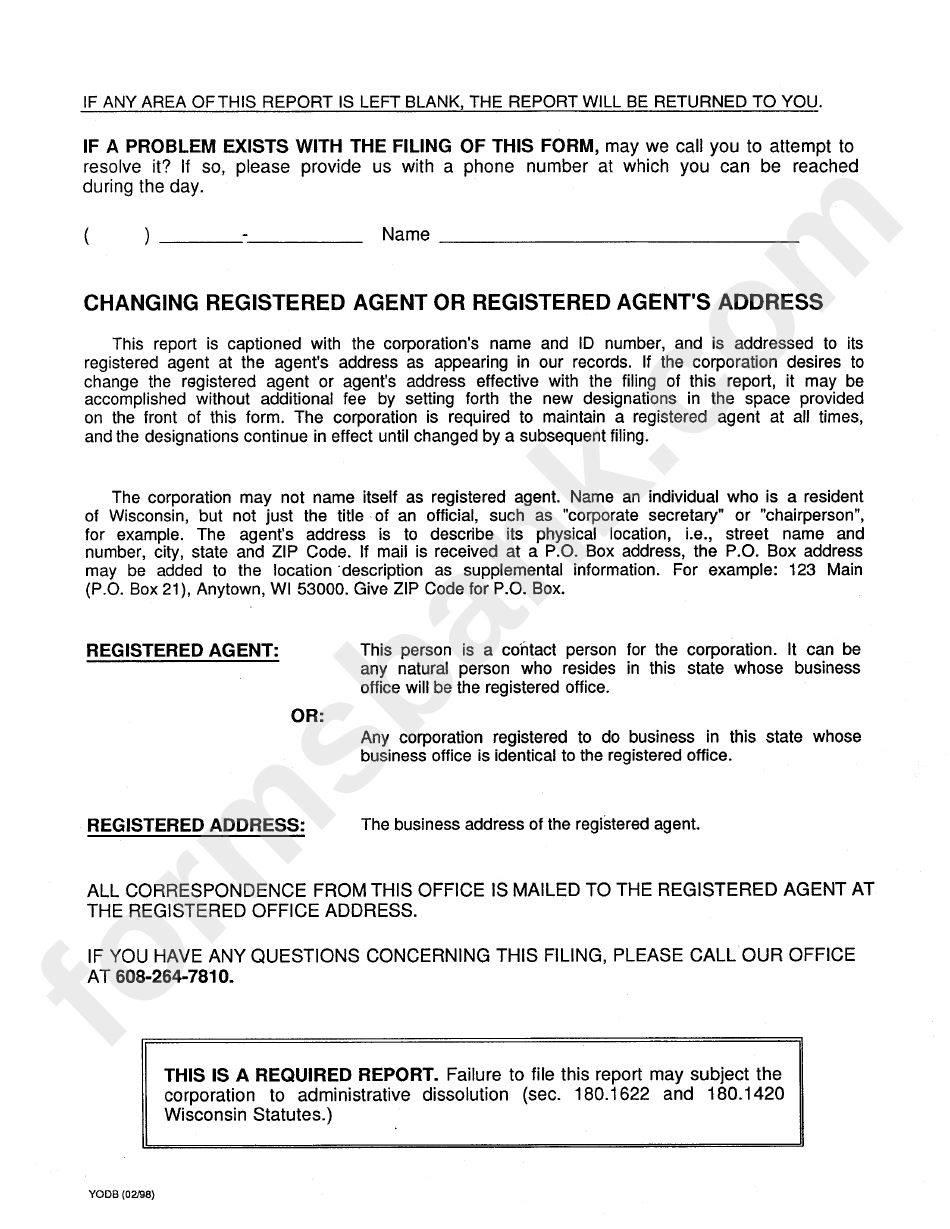

Numerous states may also require that you postal mail the annual document form together with declaring it in electronic format. The name and address in the company, in addition to any directors, administrators, or participants, will often be on the yearly record develop. Some suggests also require for that listed agent’s name and address.

is important based on condition company

Their state in which you are doing company requires you to submit a yearly report kind. This is a legal file that, in the majority of suggests, notifies the public, prospective investors, and government organizations concerning your business. A yearly record is also known as a routine document or possibly a declaration of information. Even though some states only need an annual filing from the once-a-year document, other folks require a biennial a single.

Inside the suggests where by they can be registered to conduct corporations, business and LLCs and nonprofits must file an annual report. The state may have distinctive demands for each sort of firm, along with due dates and types. While many suggests require an initial record pursuing incorporation, others only desire an annual report each 2 years.

is mandated by the status LLC

Right after a minimal responsibility company (LLC) is included, it’s essential to distribute the specified condition reviews. These records include information about the business, its members, and also the authorized representative. In addition they help the condition in ensuring the business is legit thus it can operate and be protected from financial obligations.

Once a year an LLC must submit a report to the state. Economic assertions, organization updates, and modifications to operating procedures are types of these studies. Additionally, some states will impose a fee for each and every report.