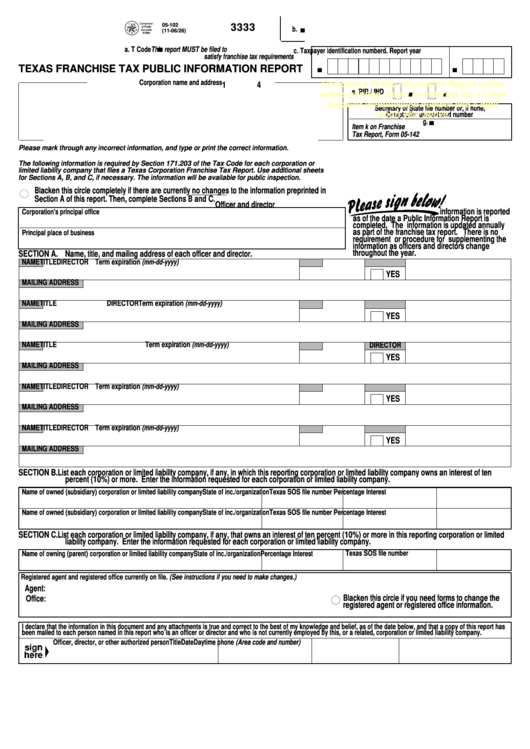

Form 05-102 No Tax Report Due

Form 05-102 No Tax Report Due – When completing your Taxes Report Type, there are a variety of things you ought to be conscious of. In Maryland, it is necessary to make known your private house as well as your company certification. You must also finish Section V if you have several locations or branches. … Read more