2022 Tax Report Form – When completing your Taxes Document Kind, there are tons of points you should be aware about. In Maryland, you are required to reveal all your individual house together with your organization certification. You must also finish Section V if you have several locations or branches. This information has more information about the different types.

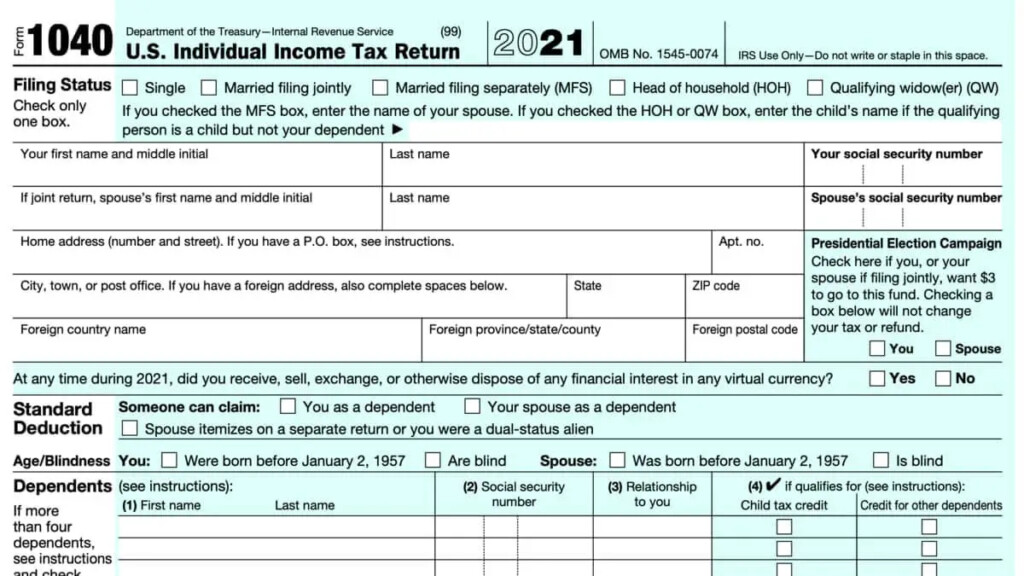

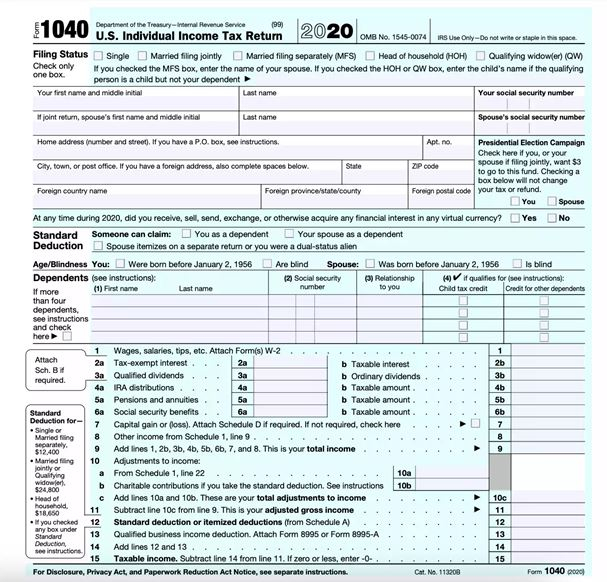

Form 1040

The tax statement Form 1040 has a number of devices. You will find 20 various sorts of agendas available for this taxes, and are generally called the attachments. The Us Recovery and Reinvestment Act’s Schedule M was one of many plans which was additional during 2009. This stimulus package highlighted a clause that made it possible for taxpayers to improve their taxes reductions by making work shell out.

Taxpayers are allowed to record revenue from a company besides the revenue declared on Form 1040. This sort of cash flow typically results from self-career. The tax payer may also disclose royalties and rental property cash flow. Additionally, Plan H contains details about domestic personnel.

A new information-reporting form known as Form 1040-NR must be submitted if the taxpayer accepts payments via a third-party network or accepts merchant cards. If a taxpayer receives more than $20,000 in revenue or more than 200 payments via third-party networks, additionally, this form must be submitted.

Daily activities

A income tax timetable is really a record needed by the internal revenue service to be filed with the tax return. This file details the tax costs you have to pay for specific income and deduction quantities. The IRS provides various schedule kinds, for example individuals for itemized reductions, money gains and lossesdividends and losses, and fascination.

EZ Routine C

The Schedule C tax report form is probably something you’re familiar with if you run a small business. This thorough kind contains questions on your company’s outlays and revenue. Regardless of whether you work with on your own or collectively operate a organization, you should publish Schedule C annually. Your gross income and costs are calculated while using information and facts you provide about the form.

To help make the entire process of submitting fees for small business owners easier, the IRS introduced Schedule C-EZ in 2018. Less complicated-to-comprehend details about your organization, including the gross income you brought in, was necessary for the Routine C-EZ. But beginning in 2019, the internal revenue service ceased allowing business owners to use Schedule C-EZ. Organizations should instead utilize the Plan C kind.

With a few significant variants, the Schedule C-EZ income tax document develop is comparable to the standard Plan C. As an alternative to listing them in types, it is possible to document all of your organization expenditures on one line. Furthermore, you don’t have to disintegrate bills by school. However, keep in mind that this option is only available for certain tax years.

Schedule H

If your organization is a hospital, schedule H of the tax report form must be completed. The programs and facilities your business offers to the neighborhood are wanted in this kind. The community’s health and safety ought to be enhanced with these efforts. The data you provide should be exact and up-to-date.

The information on Schedule H is crucial if you want to know if you have to pay household employment taxes. The form also asks if you have federal income tax calculates and withheld Social Security and Medicare taxes for household employees. You can also be required to pay More Medicare insurance Tax (AMT) on the salary in the event you make more than $200,000. In addition, the Schedule asks you if you have any additional income taxes such as FUTA or SUI.

A Form W-2 or Form W-3 should be provided to any family staff, and copies should also be shipped to the Social Safety Administration. The majority of tax preparation tools will assist you with Schedule H, but you might need to download Adobe Acrobat Reader in order to view the form.