2022 Illinois Annual Report Form Instructions – You should make sure to submit your annual report form on time if your business is required to do so. The deadline varies by industry, but in general, it’s April 30. A copy of the form may be downloaded, by clicking the provided link. Equally money and time will likely be saved. Moreover, filing it online will save you cash.

On the web declaring lowers fees.

The yearly document for your personal company might be posted easily by sending once-a-year document types on the web. Saving money and time is just one of the numerous great things about doing this. , although online form submission does have some disadvantages For instance, your annual report form can be returned to you if it is impossible to read your handwriting. Electronic filing requires both the online submission of the annual report form and the online credit card or debit card payment of the filing cost, however. Us Communicate is likewise accepted in many suggests.

It can cost you money if you don’t submit your online annual report forms on time. The vast majority of suggests require yearly records be sent in. For instance, charity agencies are exempt from filing charges but are still suggested to create a backup for his or her records. In order to avoid being viewed as delinquent and rescinded, annual report forms must also be submitted by a specific deadline. In a few suggests, you might have ninety days from your because of particular date to file your records. If you don’t submit your paperwork on time, and your records may be permanently destroyed, your business may be deemed in default.

National securities rules mandate it.

The sale of securities is controlled by a set of rules and laws referred to as national securities regulations. These laws and regulations are targeted to battle scams in the selling of securities. Generally, the Securities Respond of 1933 mandates that brokers receive complete disclosure of securities ahead of their obtain. Once the stability comes by means of snail mail, the respond also mandates disclosure.

Organizations must publish persistent studies to the SEC. These reviews has to be depending on fiscal claims licensed by unbiased an accountant. These records are available in the EDGAR data bank and must be disclosed to buyers.

Needs vary by state

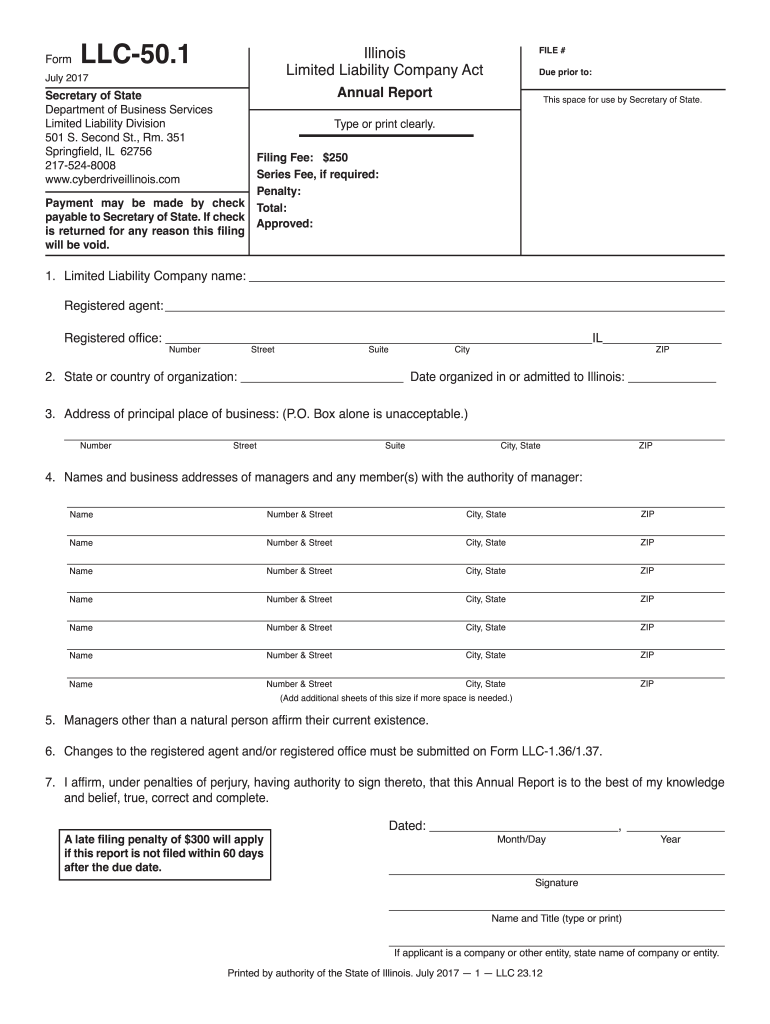

Based on the state you do enterprise in, annual report declaring is usually necessary. While others have a different due date based on the anniversary of the business’ formation, some states require filing of an annual report before a fixed calendar date. Your annually statement might also need to be sent in in electronic format or on paper according to the status. It is actually suggested that you simply distribute your once-a-year record develop as early as possible in order to avoid late fees and penalties.

A lot of states will likely expect you to snail mail the yearly report form along with submitting it electronically. The address and name in the firm, as well as any directors, executives, or participants, will probably be on the annual record type. Some states also need for the listed agent’s name and address.

is needed depending on state corporation

The state in which you are performing business needs one to send an annual record develop. It is a lawful papers that, in nearly all suggests, informs the general public, prospective investors, and government companies concerning your business. An annual report is also referred to as a occasional statement or even a declaration of real information. While many says only need a yearly submitting from the once-a-year report, other folks require a biennial one.

Within the claims exactly where these are listed to execute LLCs, business and corporations and nonprofits should document a yearly record. The state could have specific needs for every form of business, in addition to expected schedules and forms. Although some states require an initial report following incorporation, other individuals only desire a yearly report each and every 2 years.

is mandated through the state LLC

After having a minimal responsibility corporation (LLC) is incorporated, it’s crucial to send the required express reports. These records involve information regarding the organization, its members, and the listed professional. Additionally, they help the status in guaranteeing the firm is legitimate thus it can be and operate shielded from financial obligations.

An LLC must submit a report to the state once a year. Financial statements, business changes, and changes in operating methods are types of these studies. Furthermore, some says will impose a fee for every single record.